Maybank Conventional Fixed Deposit

- Maybank Fixed Deposit Promotion

- Maybank Conventional Fixed Deposit Rate 2019

- Maybank Fixed Deposit Rate

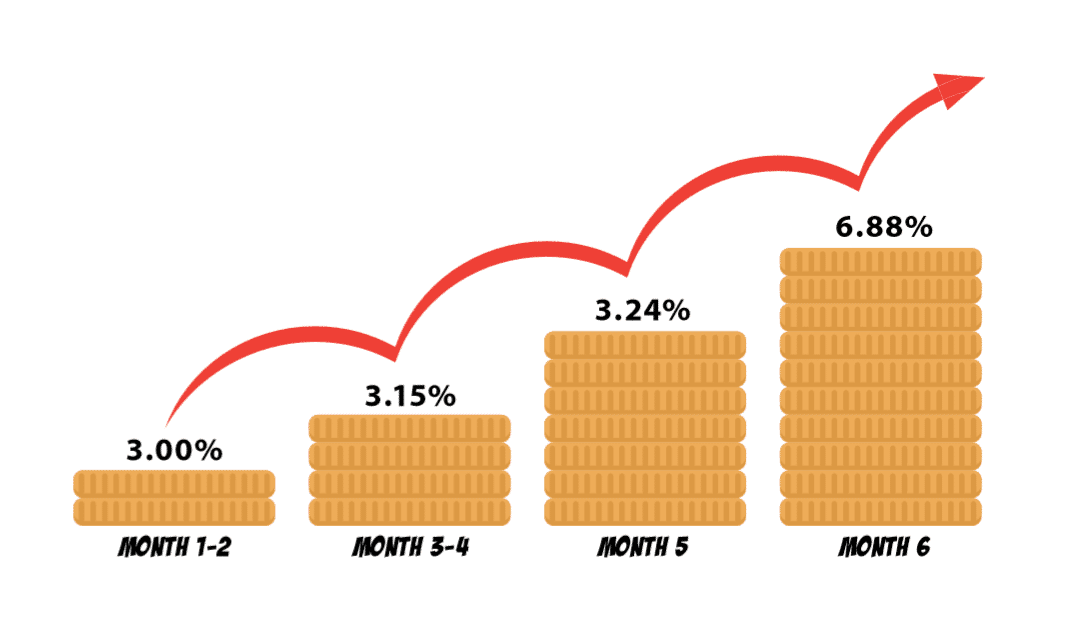

Starting from 17th August 2009, Maybank launch a special campaign for Conventional Fixed Deposit. Individual who placed a conventional Fixed Deposit during this campaign period will enjoy double bonus on Fixed Deposit Rate.

What is Maybank eFixed Deposit? This is a fully online fixed deposit (FD) account with a tenure of up to 60 months. An easy application can be done via Maybank2u or Maybank2u Mobile App. New placements and withdrawals can be made in real-time anywhere, anytime. Among the highest time deposit interest rates in Singapore. Minimum deposit of S$1,000 (from 2 months onwards) Placement periods from 1 to 36 months. Automatic renewal of your deposit placements upon maturity. Maybank Privilege, Maybank Private, and Maybank Premier customers can get the benefits of Chinese New Year FD Campaign when the minimum sum is placed in a Conventional Fixed Deposit account. A Maybank Privilege customer can get a promotional rate of 4.00% p.a. When a minimum sum of RM100,000 is deposited in fresh funds.

The first bonus is, individual who make 1, 2 or 3 months Fixed Deposit will we reward with high interest rates & the second bonus is the higher interest rates will be maintain on the next renewal. To participate in this promotion individual must be make a Fixed Deposit with minimum of RM20,000.00 at any Maybank Branch nationwide or through Maybank2U internet banking via eFixed Deposit.

Below are some of the points that you have to take note if participating in this promotion.

What Is An Islamic Fixed Deposit Account?

An Islamic Fixed Deposit Account (Islamic FD, or commonly referred to as Islamic Fixed Deposit-i or General Investment Account-i) is a financial instrument that offers a fixed profit / return upon the maturity of the deposits. The key difference conventional and Islamic FDs is that Islamic Fixed Deposits are Shariah compliant.

How Does Islamic FD Work?

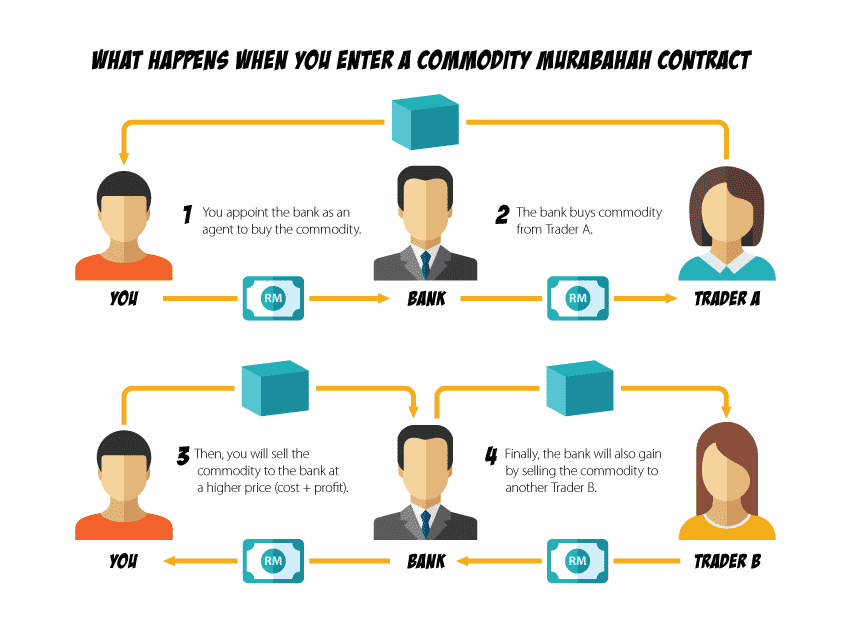

According to the principles of Shariah, the payment or acceptance of interest (riba) is strictly prohibited. In order to generate additional returns from your deposits without involving interest, an Islamic FD typically adopts a Shariah concept known as murabahah, or cost plus, which refers to the sale of goods at a profit margin agreed between two parties. To make it Shariah-compliant, both the seller and the buyer must know the cost and the profit margin right from the start, so that there is no financial uncertainty.

When you place a deposit into an Islamic FD, you are essentially purchasing an approved Shariah-compliant commodity and selling the said commodity at an agreed marked-up price to the bank on a deferred payment basis (i.e. to be paid upon the maturity date). As a result, you generate additional returns from your funds without involving the concept of interest.

How To Generate Higher Return From Your Islamic FD?

Like conventional FDs, different Islamic FD give you different rates of return. To get the best return from your Islamic FD deposits, you can consider doing the following:

Sign up for Islamic FD promotions: In Malaysia, banks generally run Islamic FD promotions several times a year, where the rates of return are higher than the board rate. To watch out for these promotions, visit iMoney’s online calculator regularly (scroll up to use the calculator).

Compare the rates: Different banks offer different rates of return for their Islamic FD. Before you sign up for one, do the necessary comparisons on iMoney’s online calculator to make sure you are getting the best possible rate.

Extend your FD period: Just like a conventional FD, your Islamic FD generates higher return for longer FD period. If you plan to place a deposit for an extended period of time, always ensure you have enough funds to sustain yourself without having to make an early withdrawal from your Islamic FD, or you may lose part or all of your return.

What Happens If You Make Premature Withdrawal From Your Islamic FD?

Maybank Fixed Deposit Promotion

Though premature withdrawal is allowed for Islamic FD in Malaysia, you will commonly lose all return if you make a premature withdrawal within the first three months. If you make a premature withdrawal after three months, you get to keep 50% of the return generated from your deposit.

Maybank Conventional Fixed Deposit Rate 2019

Is Your Islamic FD Secure?

Maybank Fixed Deposit Rate

In Malaysia, Perbadanan Insurans Deposit Malaysia (PIDM) provides free protection for all deposits (conventional or Islamic) made at a PIDM member bank. Should your bank fail, PIDM insures you against the loss of your deposits for a maximum of RM250,000 per depositor per bank. To make sure your deposits are protected, keep an eye out for the PIDM sign to ascertain that your bank is indeed a PIDM member bank. If you have more than RM250,000, you can opt to deposit in sums of RM250,000 at different banks to protect your money. Alternatively, you can also consider placing your money with the same bank using a conventional banking account or a joint-name account, as they are insured by PIDM separately. For more information on PIDM, click here.